Kodak's AHU Film Drives New Market Potential for Compact ECN‑2 Processors

Share

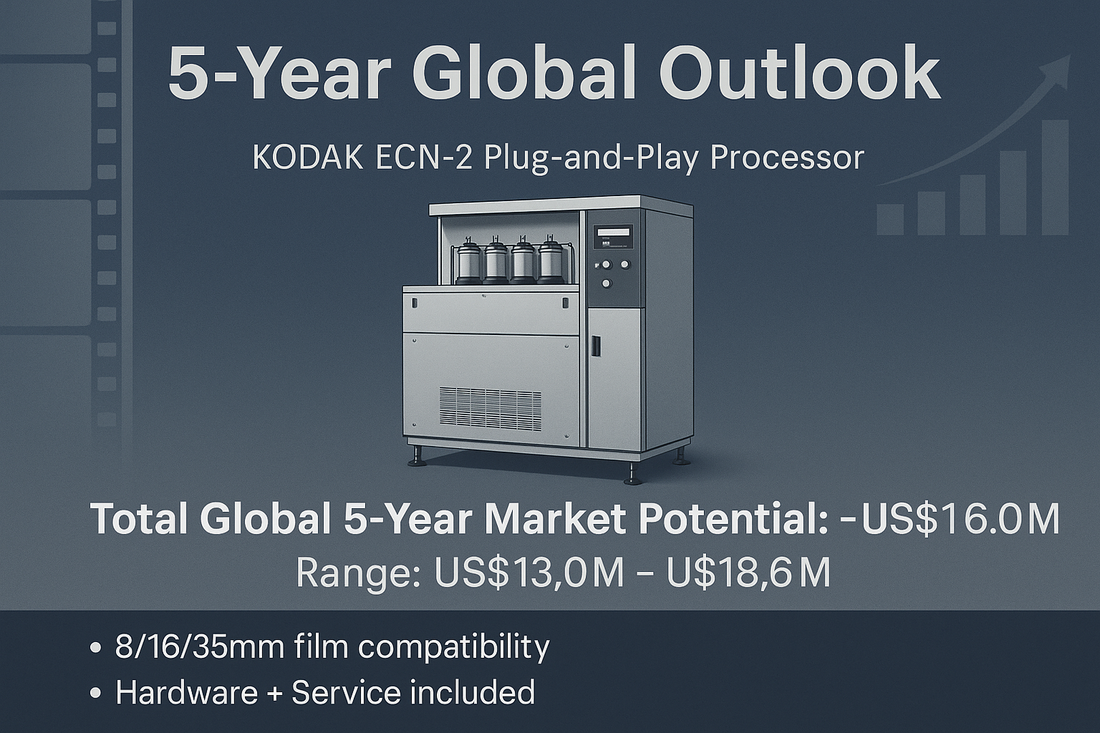

5‑Year Global Outlook • ECN‑2 Plug‑and‑Play Processor (8/16/35mm) • See price footnote[1]

Kodak's AHU Film Drives New Market Potential for Compact ECN‑2 Processors

Total global 5‑year market potential (Base Case, modeled): ≈ US$16.0M (range ~US$13.0M–US$18.6M), incl. hardware + separately sold service[1]

Executive summary

Global feature film production rebounded to a historic high in 2023 (9,511 features; +68% vs 2020 and +2% vs 2019), ensuring a robust pipeline that supports analog niches requiring ECN‑2 processing infrastructure. [WIPO]

Kodak is expanding film manufacturing capacity for both still and motion pictures, reducing supply anxiety and encouraging labs, boutiques, schools, and archives to invest in new processing lines. [Kodak Investor Relations]

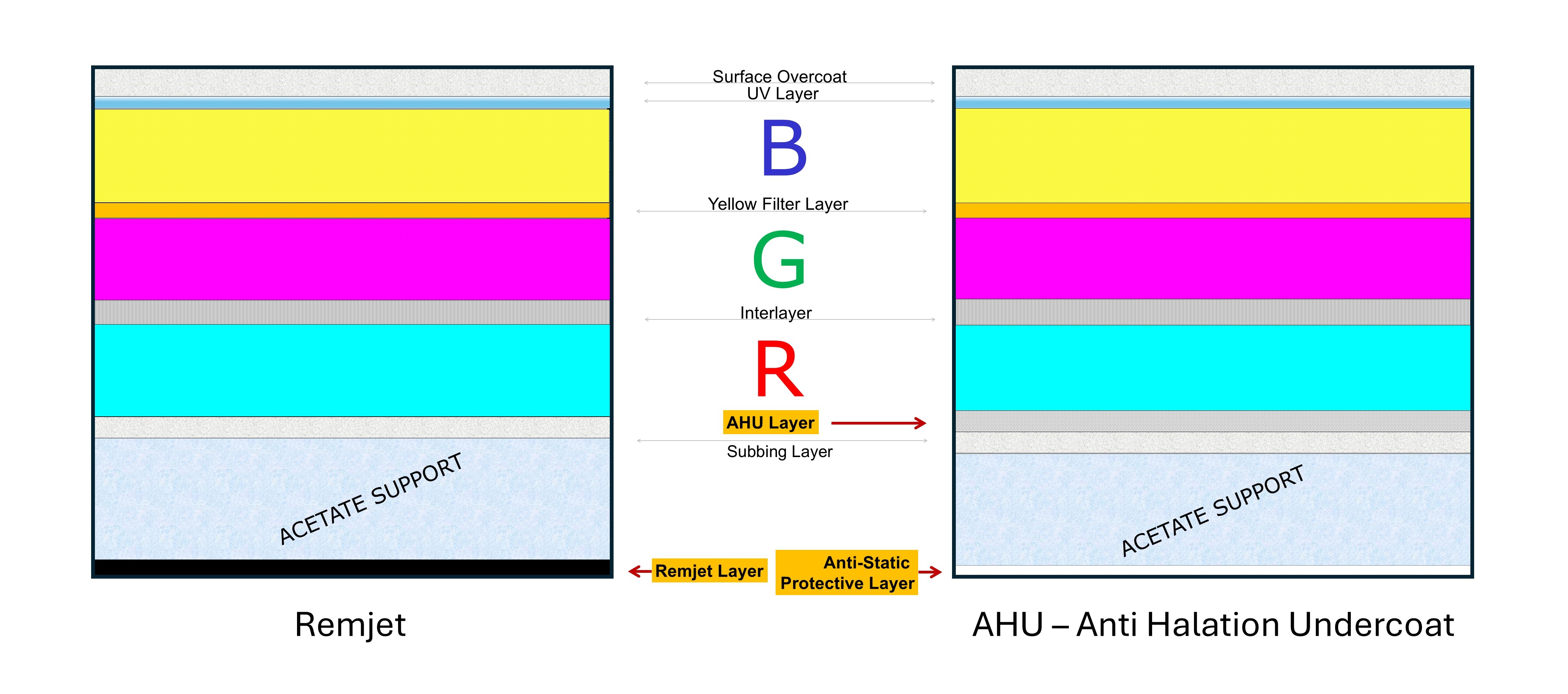

The pivotal catalyst is Kodak's remjet‑less VISION3 "AHU" film structure, which eliminates the remjet pre‑bath and significantly reduces water, chemical, and energy use—exactly the factors that previously complicated small, compact ECN‑2 lines. This directly improves feasibility and TCO for plug‑and‑play processors. [Kodak] [American Cinematographer]

Premium exhibition and creative signals remain strong: IMAX achieved $1.06B global box office in 2023 with a record 5.9% domestic share in Q1 2024, and dozens of 2023 releases were shot fully or partly on 35mm—sustaining the business case for film workflows. [IMAX] [The Hollywood Reporter] [Filmmaker Magazine]

5‑Year Install Potential (hardware‑only[1]): Conservative 60–90 units; Base Case 110–140 units; Upside 180–220 units. Service/maintenance is sold separately (typical 8–12%/year programs; modeling only).

Tokyo Laboratory remains active in film processing, printing, and preservation workflows. [Kodak]

Why now: AHU lowers barriers for compact processors

Kodak's AHU redesign replaces remjet with an Anti‑Halation Undercoat and integrated anti‑static protection, preserving image performance while simplifying processing, saving water by "millions of gallons" globally per year, reducing pre‑bath chemicals by >50,000 gallons, and cutting energy use up to 100,000 kWh annually. [American Cinematographer] [Kodak]

For compact ECN‑2 machines, fewer wet stages and no remjet pre‑bath translate into reduced operator burden, lower fouling and cleaning cycles, and more predictable maintenance—key for boutiques, schools, and archives. [American Cinematographer]

Market drivers and signals

Production base: 9,511 features produced globally in 2023 confirms a normalized pipeline beyond pandemic volatility. [WIPO]

Premium exhibition: IMAX's $1.06B global 2023 box office and 5.9% domestic share in Q1 2024 show persistent audience appetite for differentiated cinematic experiences where film often plays a role. [IMAX] [The Hollywood Reporter]

Creative adoption: 2023 saw 35mm used across mainstream titles and auteurs, reaffirming film's premium aesthetic. [Filmmaker Magazine]

Supply confidence: Kodak is expanding film manufacturing capacity for motion and still film, reducing stock‑out risk that historically discouraged capex. [Kodak Investor Relations]

ECN‑PRO2 promotional video (plug‑and‑play positioning for motion film processing). [YouTube]

Addressable base and buyers

Kodak's lab directory lists ~67 motion‑picture labs across 28 countries (with independent lists >100), indicating immediate upgrade/redundancy prospects and greenfield boutique opportunities where AHU lowers barriers. [Kodak Lab Directory] [super8.tv]

Schools and archives remain important buyers due to curriculum needs and ongoing analog preservation; reduced water/chemical/energy loads under AHU are persuasive for institutional approvals. [American Cinematographer] [Kodak (Tokyo Laboratory)]

Retail ECN‑2 service pricing indicates monetizable demand even for consumer lengths (e.g., ~$27/roll in the U.S.; ~$8–$9+ in Hong Kong), supporting boutique lab cash flows beyond long‑footage dailies. [National Photo] [CameraFilmPhoto]

Market sizing and scenarios (hardware‑only; service sold separately)

5‑year cumulative installs (global): Conservative 60–90 units; Base Case 110–140; Upside 180–220. Yearly Base Case cadence (illustrative): 2025: ~15; 2026: ~21; 2027: ~25; 2028: ~30; 2029: ~34 (≈125 total). AHU availability (initially limited as remjet is phased out) is the key near‑term governor. [American Cinematographer]

Charts below are planning illustrations—adjust to your pipeline. Hardware revenue is separate from optional maintenance/service contracts.

Top 10 Countries (5‑Year Base Case Midpoint Installs)

Directionally ranked by lab density, production ecosystems, education/archives, and geographic need for local capacity. [Kodak Lab Directory]

5‑Year Unit Ramp (Base Case Illustration)

Illustrative annual deployment pattern reflecting AHU ramp and institutional cycles. [Kodak] [American Cinematographer]

Vendor Revenue Mix (Base Case Illustration)

Hardware (units × $90k) shown separately from service (assumed 10%/yr, 85% attach across 5 years). These are model assumptions, not quotes.

TCO and maintenance (service sold separately)

Example 5‑year buyer TCO: $90,000[1] hardware + $45,000 service (10%/yr) + $5,000 install/training + $5,000 spares ≈ $145,000 before utilities/chemistry. Under AHU, reduced water/chemical/energy usage lowers running costs compared to remjet‑era processes. [American Cinematographer]

Maintenance scope for compact ECN‑2: bath calibration, replenisher dosing control, transport cleaning/rollers, pump/seal checks, firmware updates, and AHU‑specific process validation. Fewer wet stages and no remjet pre‑bath reduce fouling and simplify preventive maintenance. [American Cinematographer]

Kodak VISION3 enhancement: Anti‑Halation Undercoat (AHU) replaces remjet, simplifying lab operations and reducing resource use. [American Cinematographer]

Top 10 country breakdown (Base Case)

Leading adopters by expected installs over 5 years: United States, United Kingdom, Germany, France, Japan, China, India, Canada, Italy, Australia—reflecting lab density, production ecosystems, education/archives, and geographic need. [Kodak Lab Directory]

- United States: Dense lab base (e.g., Kodak Film Labs), premium features/ads, strong film‑school and archival sectors; IMAX market share supports premium workflows. [Kodak Film Labs] [The Hollywood Reporter]

- United Kingdom: Cinelab/Kodak Lab London; London‑centric production and education. [Kodak Lab Directory]

- Germany: Andec, SILBERSALZ; vibrant advert and arts markets. [Kodak Lab Directory]

- France: Labs and restoration tradition; auteur cinema. [Kodak Lab Directory]

- Japan: Ongoing analog operations (Tokyo Laboratory), commercials/features, preservation. [Kodak]

- China: Large production market; strong IMAX local language box office; multiple labs. [IMAX] [Kodak Lab Directory]

- India: World‑leading output; expanding education and boutique lab runway under AHU. [WIPO]

- Canada: Toronto/Vancouver hubs; film schools; proximity to U.S. work. [Kodak Lab Directory]

- Italy: Cinecittà ecosystem; restoration heavyweights (e.g., L'Immagine Ritrovata). [Kodak Lab Directory]

- Australia: Active commercial/indie scenes; strong universities; distance necessitates local capacity. [Kodak Lab Directory]

ECN‑2 context: remjet historically required pre‑bath/water‑jet removal; AHU removes this step, easing compact lab operations. [Carmencita Film Lab]

Bottom line

With hardware priced at US$90,000[1] and service sold separately, the 5‑year Base Case remains 110–140 units globally ($9.9M–$12.6M in hardware), plus a meaningful, separately contracted service stream under typical 8–12%/year programs. AHU is the core unlock that broadens the buyer set and improves TCO for compact ECN‑2 installs. [Kodak] [American Cinematographer] [Kodak Lab Directory] [WIPO]

Creator pipeline signal: Kodak's Super 8 camera (niche but influential) underscores ecosystem vitality for S8/16/35mm processing. [The Verge]

Footnotes

- MSRP US$90,000 is hardware‑only and excludes after‑sales service/maintenance, installation/training, and consumables. Service programs shown are illustrative (8–12%/year of hardware). ↩

Contents

- Executive summary

- Why now: AHU lowers barriers

- Market drivers and signals

- Addressable base and buyers

- Market sizing and scenarios

- TCO and maintenance

- Top 10 country breakdown

- Bottom line

Key Entities

Key Sources

WIPO global feature output (2023): 9,511 films (+68% vs 2020; +2% vs 2019). [WIPO]

Kodak expanding film manufacturing capacity. [Kodak Investor Relations]

Kodak AHU announcement and details. [Kodak]

AHU environmental/process implications and rollout. [American Cinematographer]

IMAX 2023 global box office ($1.06B) and Q1 2024 domestic share (5.9%). [IMAX] [The Hollywood Reporter]

Kodak global lab directory; geographic coverage. [Kodak Lab Directory]